south dakota vehicle sales tax exemption

13 rows In South Dakota certain items may be exempt from the sales tax to all consumers not just. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue

South Dakota offers a partial property tax exemption up to 150000 for disabled Veterans and their Surviving Spouse.

. This exemption applies to the house garage and the lot up to one acre. There are hereby specifically exempted from the provisions of this chapter and from the computation of the amount of tax imposed by it the gross receipts from sales of tangible personal property and the sale furnishing or service of electrical energy natural and artificial gas and communication service to the United States to the State of South Dakota or to any other. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

E Capitol Ave Pierre. In lieu of sales and use taxes a 4 excise tax is imposed on most motor vehicle transactions except boats unless exempt. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32.

The total sales tax rate in any given location can be broken down into state county city and special district rates. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32-5-27. Streamlined Sales and Use Tax Agreement.

Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must. 2021 South Dakota state sales tax. Sales Tax and Use Tax.

South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. A title transfer fee of 1000 will apply. SDL 32-5-2 are also exempt from sales tax.

The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. South Dakota has a statewide sales tax rate of 45 which has been in place since 1933. 1151 in South Dakota that is governed by the tribe in which you are a.

In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. Do not remit additional state tax on these transactions. The product or service is specifically exempt from sales tax.

If the actual value of the home increases the homeowner. Use tax is due on purchases if no sales tax has been imposed. A vehicle is exempt from tax when it is transferred without consideration no money is exchanged between spouses between a parent and child and between siblings.

The maximum local tax rate allowed by South. Sales tax is assessed on products and services at the time of purchase lease or rental. You are attaching the Multi-State Supplemental Form.

Exemptions from Sales Tax. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. South Dakota has 142 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

AND 2reside on Indian country as defined by 18 USC. Motor Vehicles Motor Homes and Mobile Homes - The sale of motor vehicles and motor homes are not subject to sales tax when subject to the South Dakota Registration fee. This includes the following see.

1be an enrolled member of a federally recognized Indian tribe. The purchaser is a tax exempt entity. Credit is given tor trade-ins to licensed dealers.

This means that you save the sales taxes you would otherwise have paid on the 5000 value of your trade-in. The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2. You can download a PDF of the South Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page.

The purchaser submits a claim for exemption. Municipal governments in South Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 65 across the state with an average local tax of 1814 for a total of 6314 when combined with the state sales tax. Exact tax amount may vary for different items.

Motor vehicles exempt from the motor vehicle excise tax under. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. Motor Vehicle Exemptions 14-Any motor vehicle sold or transferred which is eleven or more model years old and which is sold or transferred for 2500 or less and any boat which is eleven or more model years old and which is sold or transferred.

Mobile homes or manufactured HUD homes are subject to a 4 ini- tial registration fee and are exempt from sales use and con- tractors excise tax. South Dakota has a 45 sales tax and Turner County collects an additional NA so the minimum sales tax rate in Turner County is 45 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Turner. The product is delivered to a point outside of the State of South Dakota.

Under the program a qualifying homeowners property assessment is prevented from increasing for tax purposes. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

Elderly and disabled South Dakotans have until April 1 2022 to apply for property tax relief under South Dakotas Assessment Freeze for the Elderly and Disabled Program. South Dakota Property Tax Exemption for Disabled Veterans. South Dakota Department of Revenue.

South Dakota Streamlined Sales Tax Certificate of Exemption A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the South Dakota sales tax. There are four reasons that products and services would be exempt from South Dakota sales tax. First retail sale of vehicle is taxable.

Certificate of Exemption Check. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. The excise tax is based on the purchase price of the motor vehicle listed on the bill of sale purchase order sales contract state reference or NADA.

How To Get A Certificate Of Exemption In South Dakota Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Rental Verification Form Real Estate Forms Real Estate Forms Certificate Templates Word Template

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue

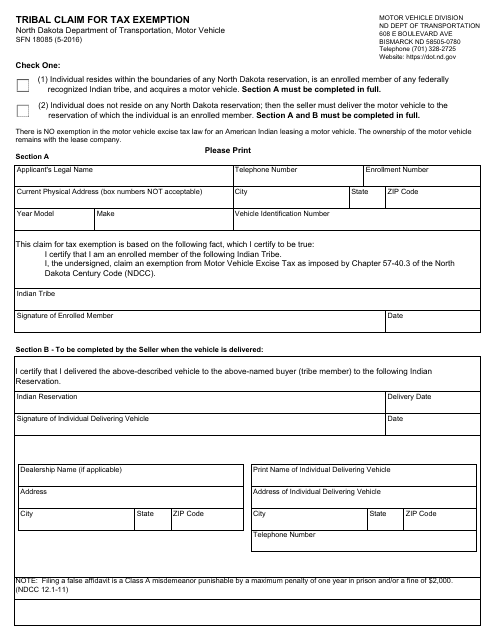

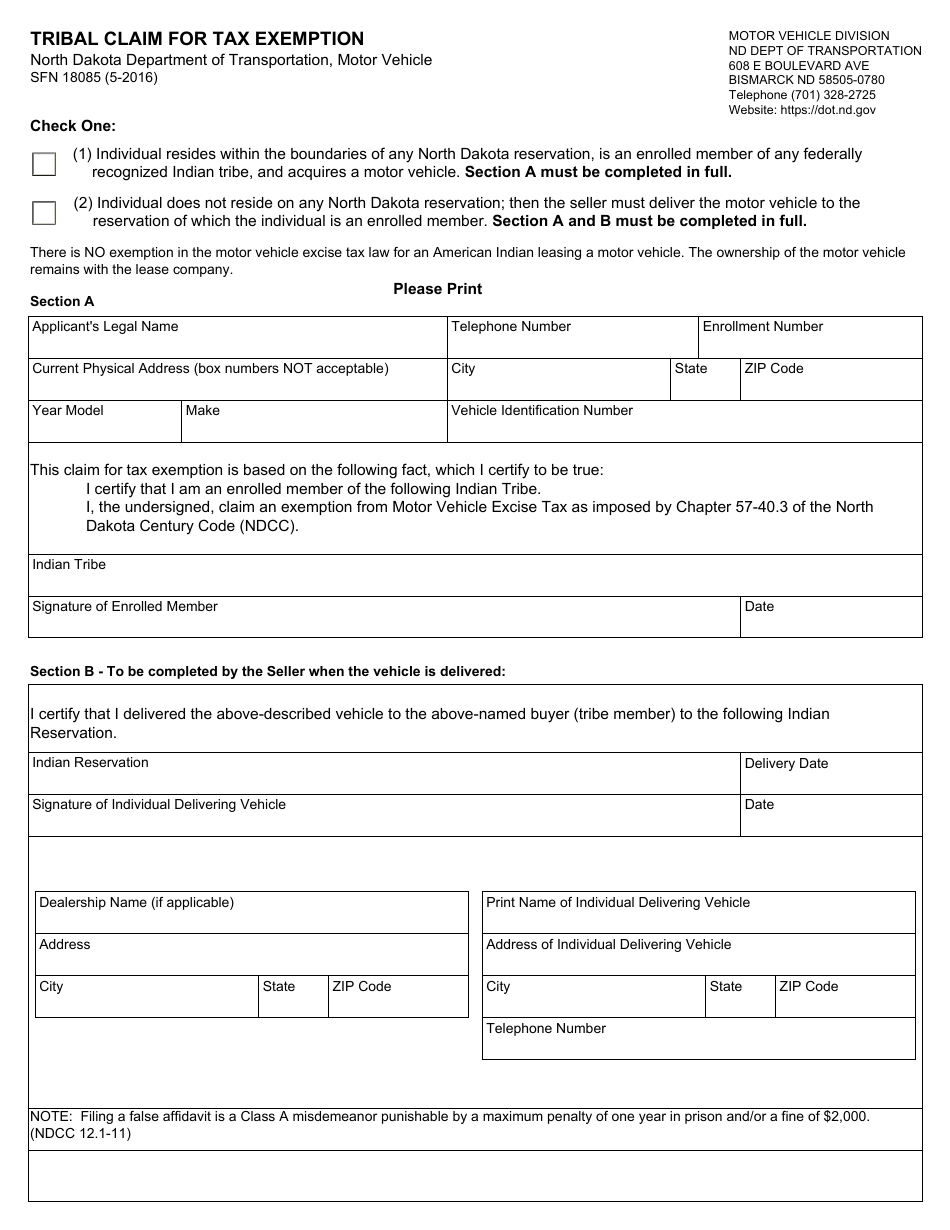

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue

Form Sfn18085 Download Fillable Pdf Or Fill Online Tribal Claim For Tax Exemption North Dakota Templateroller

My Vehicle Title What Does A Car Title Look Like Car Title Title Nevada

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Free Vehicle Donation Receipt Template Sample Word Pdf Eforms

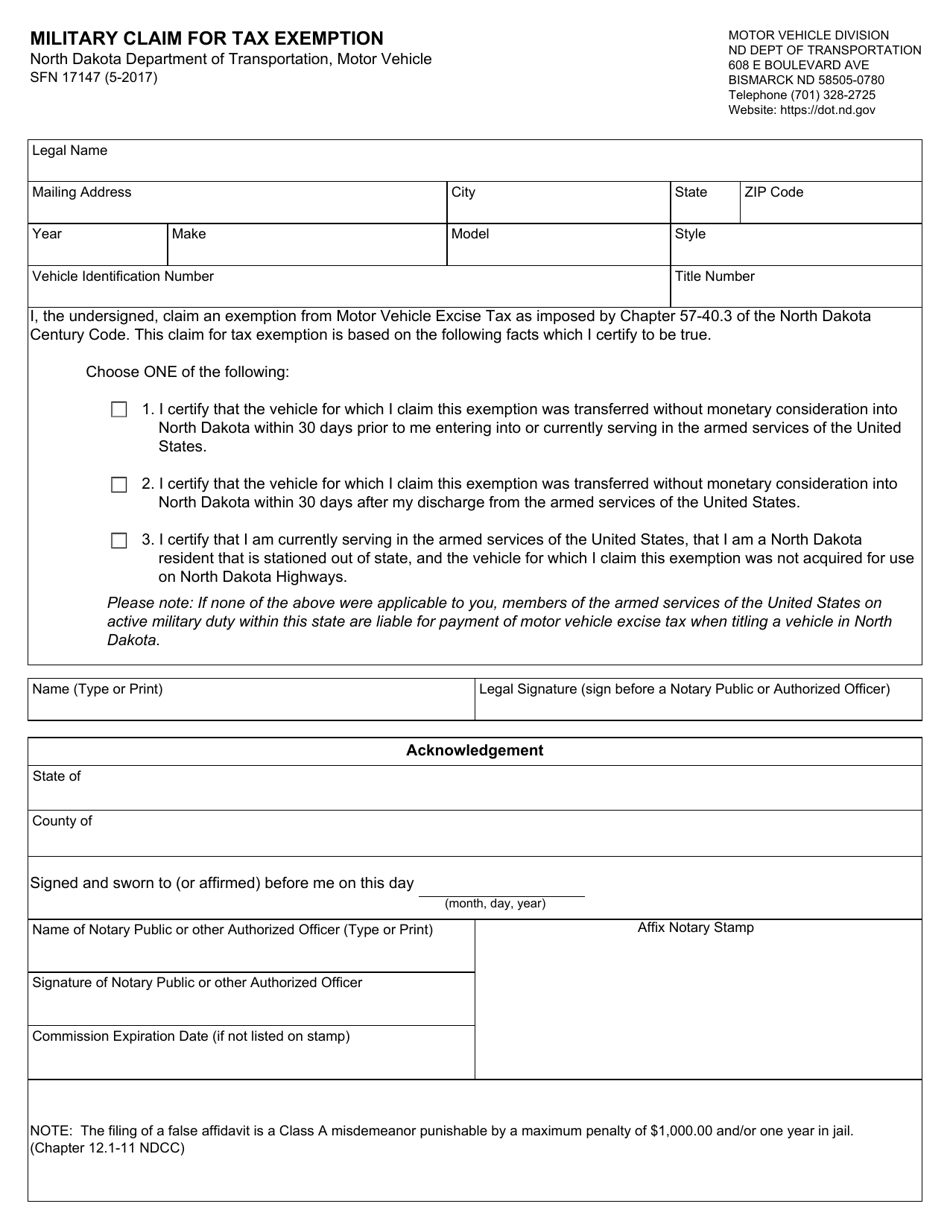

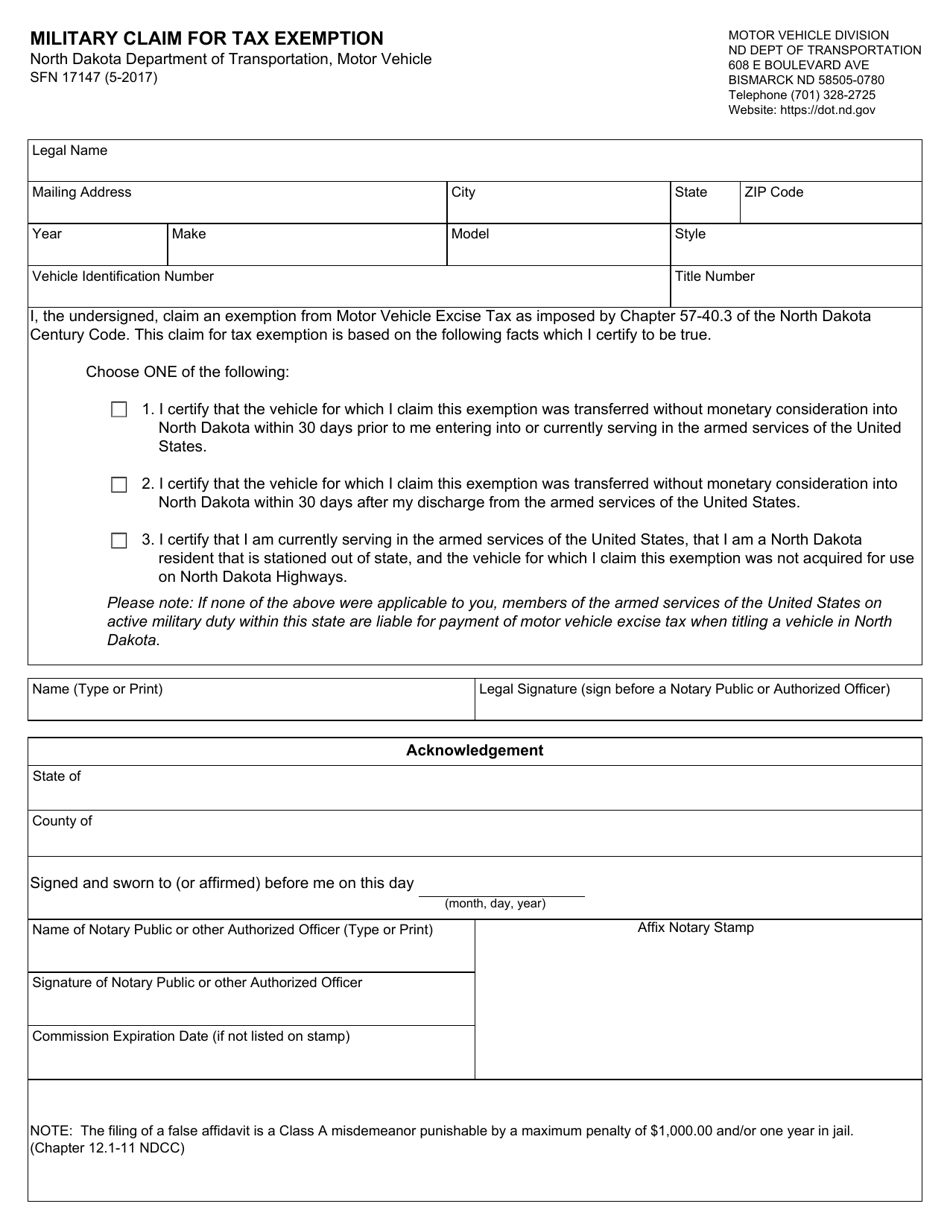

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller