how to declare mileage on taxes

2 hours agoNew IRS mileage rate for 2022. So lets do the math.

And Canada Dashers- To keep track of your total mileage and maximize your business-related deductions on your 2022 tax return we recommend using mileage tracking.

. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. You must itemize your deductions if you wish to claim a deduction for unreimbursed employee business expenses including expenses associated with using your car. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

Your business mileage use. Tax calculators. All tax tips and videos.

1 to June 30. 18 hours agoFor the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating.

56 cents per mile for business miles driven down 15 cents from 2020. You may also be able to claim a tax deduction for mileage in a few other. There are two ways to calculate mileage reimbursement.

For the 2021 tax year the rates are. The standard IRS mileage rate for the 2021. 18 cents per mile up two cents from 2021.

For example if your only miscellaneous deduction is 5000 of mileage expenses in a year you report an AGI of 50000 you must reduce the deduction by 1000 50000. Every year do recording keeping of miles. 585 cents per mile up 25 cents from 2021.

If the employer pays a mileage rate that exceeds the. Record the number of miles youve driven on your tax return. Opry Mills Breakfast Restaurants.

Restaurants In Matthews Nc That Deliver. Scroll to Self-employment income and expenses. A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate the 2022 rate is 585 cents per business mile.

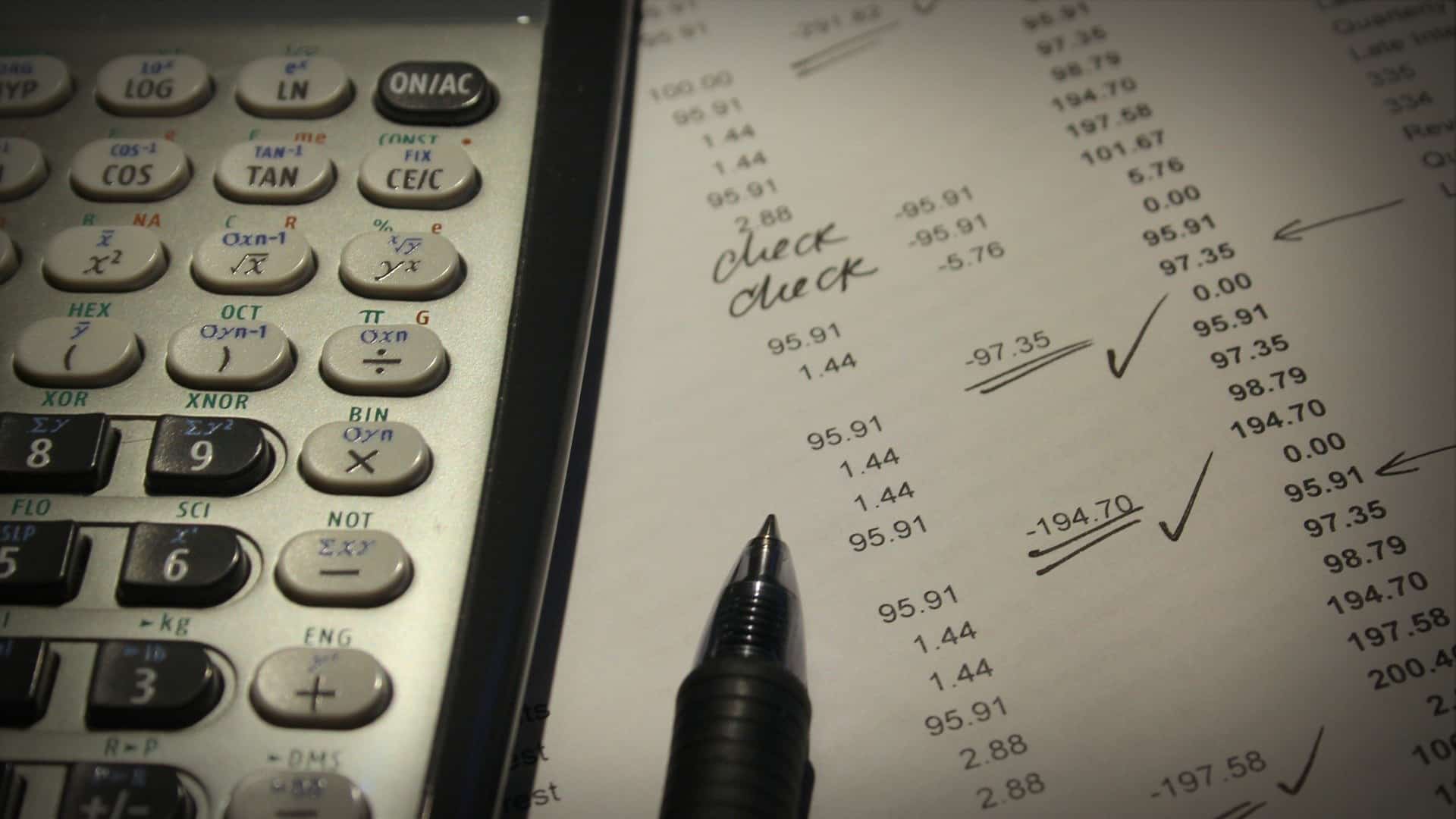

We make filing taxes delightfully simple with our flatrate price. In the past mileage logs were often paper records but now more people use mileage tracking apps designed to automate this process. For active-duty military members the new rate.

For medical or moving for qualified active-duty Armed Forces members. Check e-file status refund tracker. 17 hours agoThe new 625 cents-a-mile rate applies for eligible road travel from July 1 to Dec.

If the mileage rate exceeds the IRS rate the. In those 500 miles you did 5 business trips that totaled 100 miles. If you have a business.

This rate fluctuates yearly and applies to vehicles including cars trucks and vans. The 585 cent rate applies for eligible miles logged from Jan. If youre claiming the mileage for a business that you own it is listed in the business section.

The IRS reimbursement rate will increase to 625 cents per mile starting July 1 up 4 cents. You can calculate your mileage tax deduction for 2021 by multiplying your total business miles by the standard deduction rate of 56 cents. If you are an employee you cannot deduct gas mileage as an unreimbursed expense.

Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year. How To Declare Mileage On Taxes. To calculate your business share you would divide 100 by 500.

Tax Tools and Tips. Every feature included for everyone.

13 Types Of Yoga Teacher Tax Deductions And Other Tax Tips Brett Larkin Yoga

Blog Tax Deductible Landlord Expenses The Ultimate Checklist

What Business Mileage Is Tax Deductible

Free Sample Vehicle Delivery Note Template Google Docs Word Apple Pages Pdf Template Net Notes Template Templates Words

Tax Relief On Business Loans Makesworth Accountants

Ltd Companies Director S Expenses You Should Claim 2022

Everything You Need To Know About Tax Deductible Training Expenses Business West

How To Fill Out Your Self Assessment Tax Return This Is Money

Mileage Allowances What Is Tax Free

Claiming Car Mileage Allowance Car Mileage Claim Gst

Freelance Taxes 3 50 Deductions You Ll Want To Take To Save Money The Black And Blue

Everything You Need To Know About Mileage Allowance Finmo

Taxes For Freelance Developers How Much Tax You Should Pay As A Freelancer

12 Form Mailing Address How To Have A Fantastic 12 Form Mailing Address With Minimal Spendin Calendar Template Printable Calendar Template Irs Forms

Self Employed Mileage Deduction Guide Triplog

How Do I Tailor My Self Assessment Tax Return Youtube

Tracking Your Taxes For Direct Sales Consultants Direct Sales Consultant Direct Sales Thirty One Business

How To Declare Taxes As An Independent Consultant Sapling Lularoe Business Jamberry Business Thirty One Business