oklahoma inheritance tax rate

State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61 total rate. If your taxable income is 496600 or more the capital gains rate increases.

If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520.

. The only tax thats steeper in Oklahoma than in the rest of the country is the sales tax. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket. Explore 2021 state estate tax rates and 2021 state inheritance tax rates.

The United States does not impose inheritance taxes on the beneficiarys receipt of a bequest therefore there is no US. But theres a bit of good news herethe more closely related to the decedent someone is the less of a tax rate theyll pay. Home to the beautiful Badlands National Park South Dakota comes in fourth place with an effective state tax rate of 639.

To critics its a rigid constraint that makes an already May 02 2022 3 min read. North Dakota Known form long roads. The previous 882 rate was increased to three graduated rates of 965 103 and 109.

Alabama Mississippi and South Dakota apply the full sales tax rate on groceries which can hurt seniors. This reform was followed up with the historic tax reform measure passed this year. 4 prescriptions and food for home consumption are exempt.

That tax rate is 15 if youre married filing jointly with taxable income between 80000 and 496600. Reporting and tax rules may apply to the asset. Counties can add up to 2 in additional taxes.

The 2022 tax law will create a low flat individual income tax rate of 39 percent by 2026. Tax resulting from the death transfer. This marginal tax rate means that.

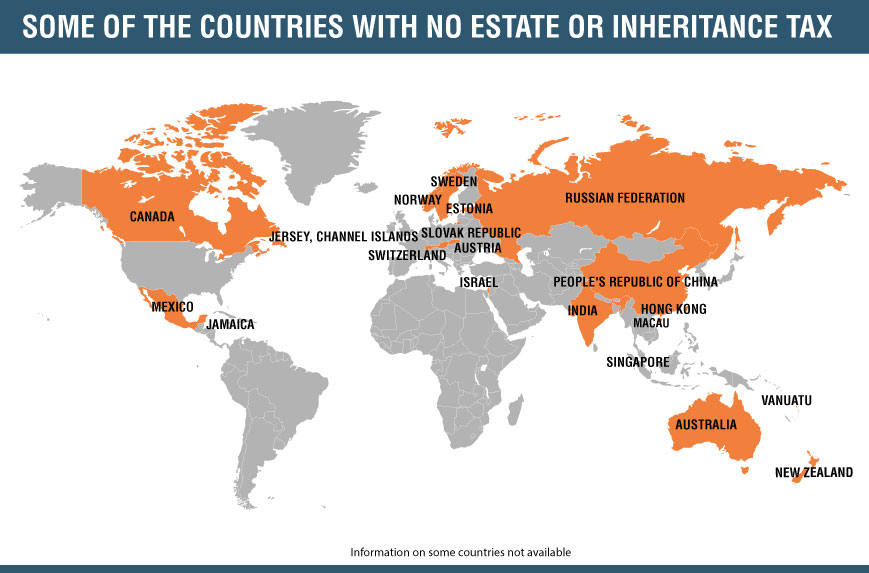

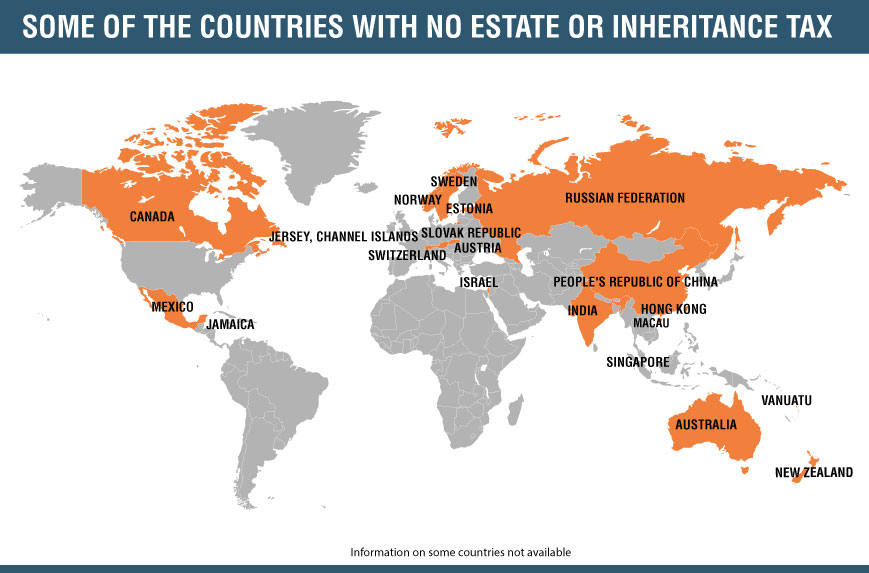

It has no estate or inheritance tax. Plus localities can add up to an additional. Twelve states and Washington DC.

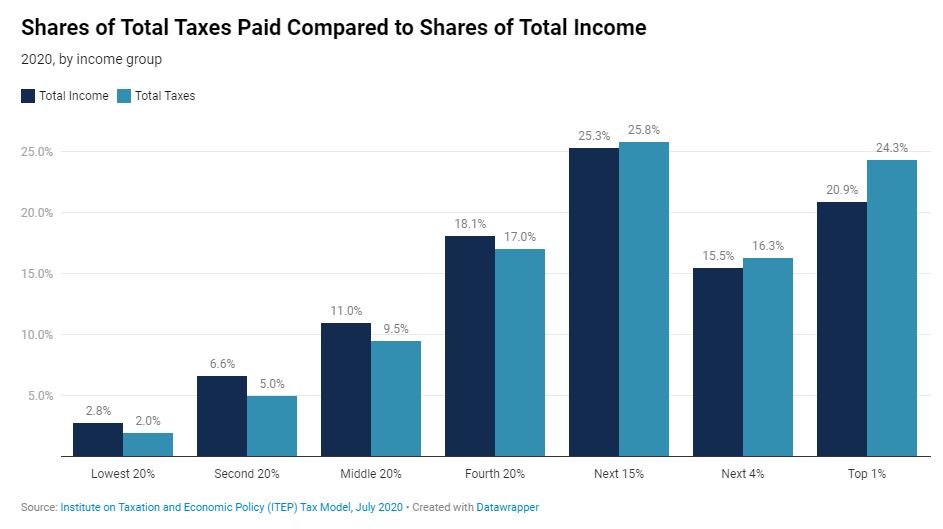

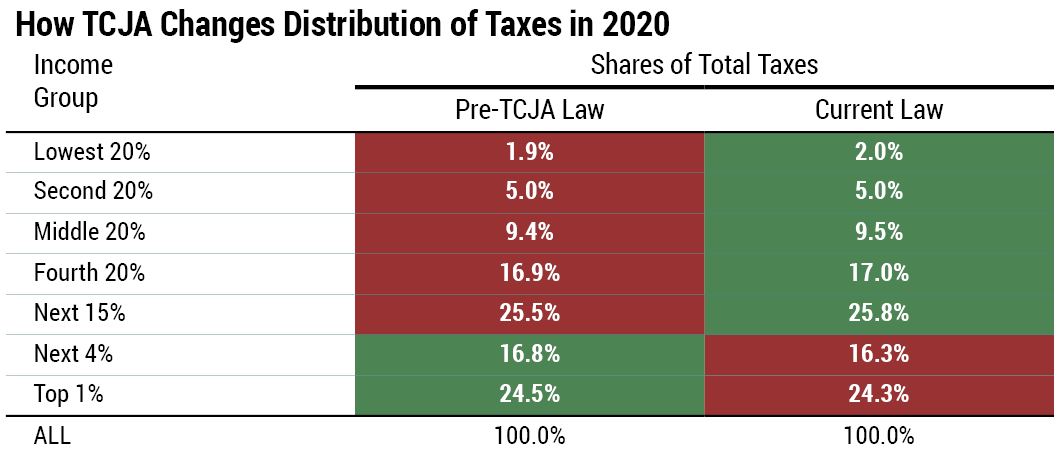

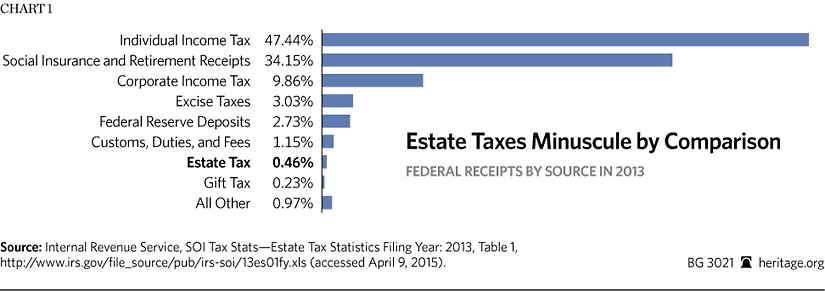

For instance the inheritance tax rate is as much as 18 in Nebraska so a beneficiary might owe the government 18000 if they inherited a 100000 account. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional state estate tax or state inheritance taxTwelve states and the District of Columbia impose estate taxes and six impose state inheritance taxes. The lower ones income the higher ones overall effective state and local tax rate.

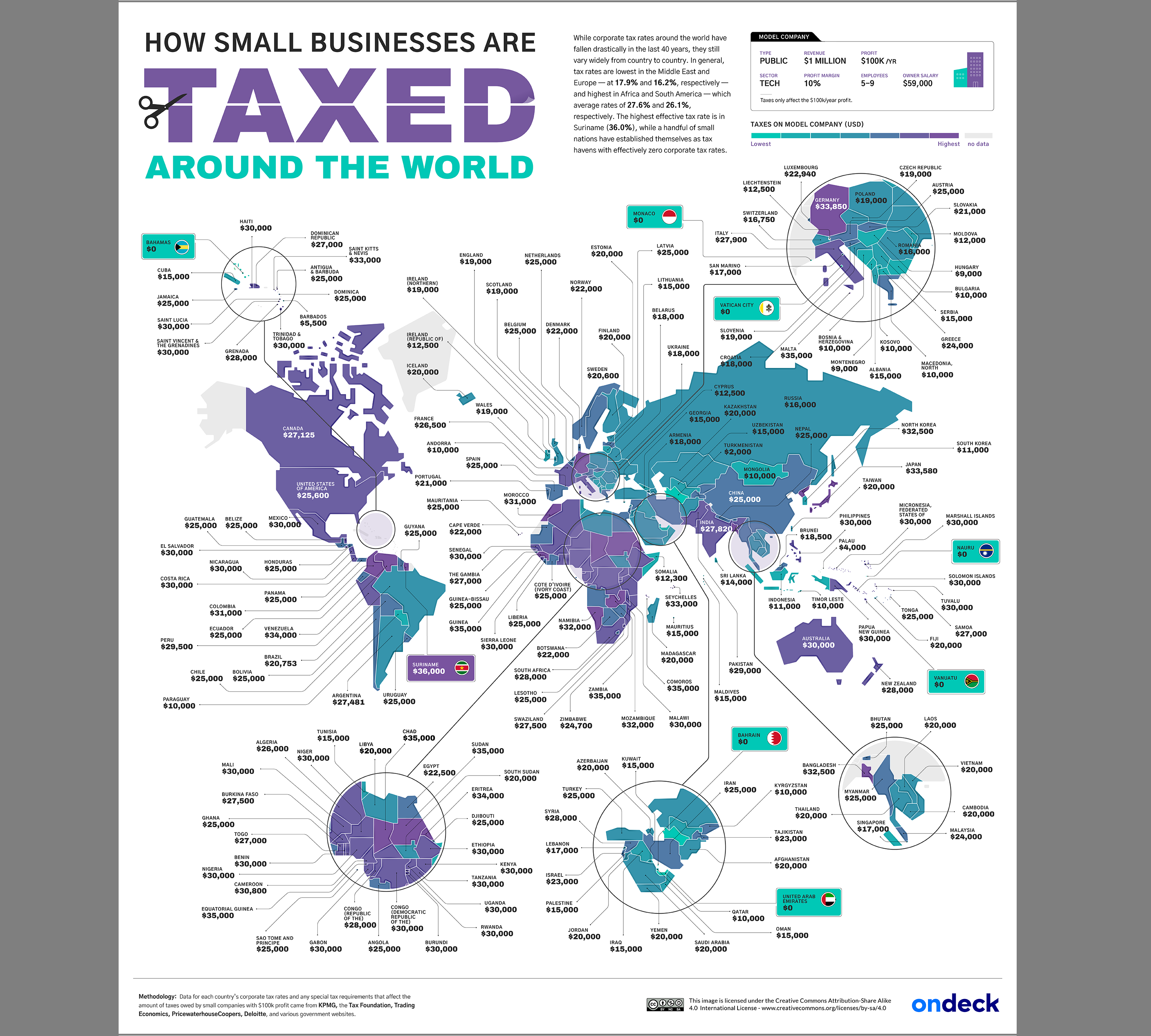

Iowas high corporate tax rate of 98 percent will be gradually reduced until it reaches a flat 55 percent. Many municipalities have both a local and state sales tax. These taxes at 236 percent are a significant source of revenue.

The sales tax and real estate taxes are average but the state has some of the lowest auto taxes in our comparison. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Each state has its own tax rates and criteria. There is no inheritance or estate tax in Oklahoma. On average it is nearly 9 in most of the state.

We would like to show you a description here but the site wont allow us. Your average tax rate is 1198 and your marginal tax rate is 22. There is no state income tax and the average sales tax is 832.

Case in point. Unfortunately unlike many other states Oklahomas sales tax. They average about 445 so a typical sales tax rate you will pay in Oklahoma is close to 9.

The nationwide average effective state and local tax rate is 114 percent for the lowest-income 20. Maryland is the only state to impose both. For further information visit the Oklahoma Tax Commission site or call 405 521-3160.

Impose estate taxes and six impose inheritance taxes. To its supporters covenant marriage is the answer to Americas rising divorce rate. Maryland is the only state to impose both a state estate tax rate and a state inheritance tax rate.

Based on earned wages Social Security benefits retirement plan withdrawals and other types of. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. A county lodging tax varies from 2 to 4 and is added to.

This calculator estimates the average tax rate as the federal income. On average the lowest-income 20 percent of taxpayers face a state and local tax rate more than 50 percent higher than the top 1 percent of households. Also the United States also does not impose an income tax on inheritances brought into the United States.

Who Pays Taxes In America In 2020 Itep

Oklahoma Property Tax Calculator Smartasset

State Death Tax Is A Killer The Heritage Foundation

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Oklahoma Property Tax Calculator Smartasset

Who Pays Taxes In America In 2020 Itep

Individual And Consumption Taxes Page 39 Of 67 Tax Foundation

Contact Congress Policy And Taxation Group

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Death Tax Is A Killer The Heritage Foundation

The Average Corporate Tax Rates In Every Country In The World Digital Information World

Oklahoma Property Tax Calculator Smartasset

Betty White S Massive Estate Tax Bill And How Life Insurance Fixes It